Sales tax and use tax numbers were up for Weatherford for the month of April, according to the Oklahoma Tax Commission (OTC)

Weatherford sales tax is up 1.22 percent compared to last year.

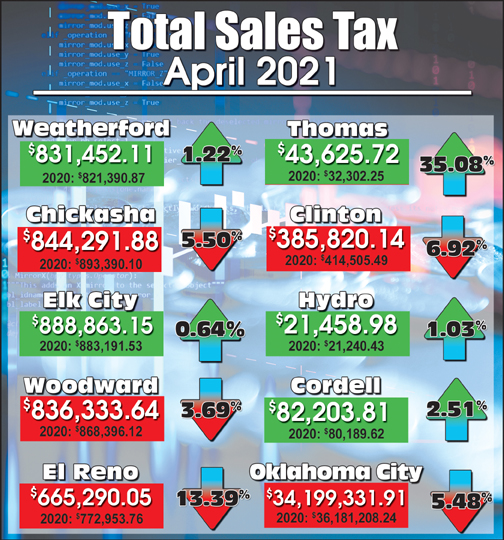

Weatherford saw an increase in April with sales tax receipts of $831,452.11 compared to last year’s numbers of $821,390.87, according to OTC. April numbers reflect sales tax collected in February.

Thomas sales tax were up by 35.08 percent, Chickasha was down 5.50 percent, Clinton was down by 6.92 percent, Oklahoma City was down 5.48 percent, Enid was down by 16.35 percent, Elk City was up 0.64 percent, Altus was up by 11.72 percent, Woodward was down 3.69 percent, El Reno was down 13.39 percent, Hydro was up 1.03 percent and Cordell was up by 2.51 percent.

The Weatherford Use Tax representing online sales was up 78.08 percent compared to last year’s collections. Weatherford collected a total of $167,426.63. Last year’s collected use tax numbers were $94,016.01.

“When we talk about sales tax and how important it is to the city it’s nice for us to start out positive for the first four months. With COVID-19 we didn’t know how sales tax numbers were going to turn out. There might be a little up and down to our numbers moving forward, but overall I think we will be at least level as the year goes on. So far we are up about 5 percent in sales tax for the year,” Mayor Mike Brown said.

Clinton’s use tax collections were up 111.63 percent and Elk City’s use tax collections were down 20.75 percent compared to last year’s collections.